Home

Bibliography

Contact

Interesting Articles

However, not all investments are made with the goal of turning a quick profit. Many investments are acquired with the intent of holding them for an extended period of time. The appropriate accounting methodology depends on obtaining a deeper understanding of the nature/intent of the particular investment. You have already seen the accounting for "trading securities" where the intent was near future resale for profit. But, many investments are acquired with longer-term goals in mind.

For example, one company may acquire a majority (more than 50%) of the stock of another. In this case, the acquirer (known as the parent) must consolidate the accounts of the subsidiary. At the end of this chapter we will briefly illustrate the accounting for such "control" scenarios.

Sometimes, one company may acquire a substantial amount of the stock of another without obtaining control. This situation generally arises when the ownership level rises above 20%, but stays below the 50% level that will trigger consolidation. In these cases, the investor is deemed to have the ability to significantly influence the investee company. Accounting rules specify the "equity method" of accounting for such investments. This, too, will be illustrated within this chapter.

Not all investments are in stock. Sometimes a company may invest in a "bond" (you have no doubt heard the term "stocks and bonds"). A bond payable is a mere "promise" (i.e., bond) to "pay" (i.e., payable). Thus, the issuer of a bond payable receives money today from an investor in exchange for the issuer's promise to repay the money in the future (as you would expect, repayments will include not only amounts borrowed, but will also have added interest). In a later chapter, we will have a detailed look at Bonds Payable from the issuer's perspective. In this chapter, we will undertake a preliminary examination of bonds from the investor's perspective. Although investors may acquire bonds for "trading purposes," they are more apt to be obtained for the long-pull. In the latter case, the bond investment would be said to be acquired with the intent of holding it to maturity (its final payment date) -- thus, earning the name "held-to-maturity" investments. Held-to-maturity investments are afforded a special treatment, which is generally known as the amortized cost approach.

By default, the final category for an investment is known as the "available for sale" category. When an investment is not trading, not held-to-maturity, not involving consolidation, and not involving the equity method, by default, it is considered to be an "available for sale" investment. Even though this is a default category, do not assume it to be unimportant. Massive amounts of investments are so classified within typical corporate accounting records. We will begin our look at long-term investments by examining this important category of investments.

The following table recaps the methods you should be familiar with by the conclusion of this chapter:

THE FAIR VALUE MEASUREMENT OPTION:

The Financial Accounting Standards Board recently issued a new standard, "The Fair Value Option for Financial Assets and Financial Liabilities." Companies may now elect to measure certain financial assets at fair value. This new ruling essentially allows many "available for sale" and "held to maturity" investments to instead be measured at fair value (with unrealized gains and losses reported in earnings), similar to the approach previously limited to trading securities. It is difficult to predict how many companies will select this new accounting option, but it is indicative of a continuing evolution toward valued-based accounting in lieu of traditional historical cost-based approaches.

AVAILABLE FOR SALE SECURITIES

The accounting for "available for sale" securities will look quite similar to the accounting for trading securities. In both cases, the investment asset account will be reflected at fair value. If you do not recall the accounting for trading securities, it may be helpful to review that material via the indicated link.

To be sure, there is one big difference between the accounting for trading securities and available-for-sale securities. This difference pertains to the recognition of the changes in value. For trading securities, the changes in value were recorded in operating income. However, such is not the case for available-for-sale securities. Here, the changes in value go into a special account. We will call this account Unrealized Gain/Loss- OCI, where "OCI" will represent "Other Comprehensive Income."

OTHER COMPREHENSIVE INCOME: This notion of other comprehensive income is somewhat unique and requires special discussion at this time. There is a long history of accounting evolution that explains how the accounting rule makers eventually came to develop the concept of OCI. To make a long story short, most transactions and events make their way through the income statement. As a result, it can be said that the income statement is "all-inclusive." Once upon a time, this was not the case; only operational items were included in the income statement. Nonrecurring or nonoperating related transactions and events were charged or credited directly to equity, bypassing the income statement entirely (a "current operating" concept of income).

Importantly, you must take note that the accounting profession now embraces the all-inclusive approach to measuring income. In fact, a deeper study of accounting will reveal that the income statement structure can grow in complexity to capture various types of unique transactions and events (e.g., extraordinary gains and losses, etc.) -- but, the income statement does capture those transactions and events, however odd they may appear.

There are a few areas where accounting rules have evolved to provide for special circumstances/"exceptions." And, OCI is intended to capture those exceptions. One exception is the Unrealized Gain/Loss - OCI on available-for-sale securities. As you will soon see, the changes in value on such securities are recognized, not in operating income as with trading securities, but instead in this unique account. The OCI gain/loss is generally charged or credited directly to an equity account (Accumulated OCI), thereby bypassing the income statement ( there are a variety of reporting options for OCI, and the most popular is described here).

AN ILLUSTRATION: Let us amend the Trading Securities illustration -- such that the investments were more appropriately classified as available for sale securities:

Assume that Webster Company acquired an investment in Merriam Corporation. The intent was not for trading purposes, control, or to exert significant influence. The following entry was needed on March 3, 20X6, the day Webster bought stock of Merriam:

| 3-3-X6 |

Available for Sale Securities |

50,000 |

||

|

Cash |

50,000 |

|||

| To record the purchase of 5,000 shares of Merriam stock at $10 per share |

Next, assume that financial statements were being prepared on March 31. By that date, Merriam's stock declined to $9 per share. Accounting rules require that the investment "be written down" to current value, with a corresponding charge against OCI. The charge is recorded as follows:

| 3-31-X6 |

Unrealized Gain/Loss - OCI |

5,000 |

||

|

Available for Sale Securities |

5,000 |

|||

| To record a $1 per share decrease in the value of 5,000 shares of Merriam stock |

This charge against OCI will reduce stockholders' equity (the balance sheet remains in balance with both assets and equity being decreased by like amounts). But, net income is not reduced, as there is no charge to a "normal" income statement account. The rationale here, whether you agree or disagree, is that the net income is not affected by temporary fluctuations in market value -- since the intent is to hold the investment for a longer term period.

During April, the stock of Merriam bounced up $3 per share to $12. Webster now needs to prepare this adjustment:

| 4-30-X6 |

Available for Sale Securities |

15,000 |

||

|

Unrealized Gain/Loss - OCI |

15,000 |

|||

| To record a $3 per share increase in the value of 5,000 shares of Merriam stock |

Notice that the three journal entries now have the available for sale securities valued at $60,000 ($50,000 - $5,000 + $15,000). This is equal to their market value ($12 X 5,000 = $60,000). The OCI has been adjusted for a total of $10,000 credit ($5,000 debit and $15,000 credit). This cumulative credit corresponds to the total increase in value of the original $50,000 investment.

The preceding illustration assumed a single investment. However, the treatment would be the same even if the available for sale securities consisted of a portfolio of many investments. That is, each and every investment would be adjusted to fair value.

ALTERNATIVE -- A VALUATION ADJUSTMENTS ACCOUNT: As an alternative to directly adjusting the Available for Sale Securities account, some companies may maintain a separate Valuation Adjustments account that is added to or subtracted from the Available for Sale Securities account. The results are the same; the reasons for using the alternative approach is to provide additional information that may be needed for more complex accounting and tax purposes. This coverage is best reserved for more advanced courses.

DIVIDENDS AND INTEREST: Dividends or interest received on available for sale securities is reported as income and included in the income statement:

| 9-15-X5 |

Cash |

75 |

||

|

Dividend Income |

75 |

|||

| To record receipt of dividend on available for sale security investment |

In reviewing this illustration, note that Available for Sale Securities are customarily classified in the Long-term Investments section of the balance sheet. And, take note the the OCI adjustment is merely appended to stockholders' equity.

HELD TO MATURITY SECURITIES

INVESTMENTS IN BONDS: It was noted earlier that certain types of financial instruments have a fixed maturity date; the most typical of such instruments are "bonds." The held to maturity securities are to be accounted for by the amortized cost method.

To elaborate, if you or I wish to borrow money we would typically approach a bank or other lender and they would likely be able to accommodate our request. But, a corporate giant's credit needs may exceed the lending capacity of any single bank or lender. Therefore, the large corporate borrower may instead issue "bonds," thereby splitting a large loan into many small units. For example, a bond issuer may borrow $500,000,000 by issuing 500,000 individual bonds with a face amount of $1,000 each (500,000 X $1,000 = $500,000,000). If you or I wished to loan some money to that corporate giant, we could do so by simply buying ("investing in") one or more of their bonds.

The specifics of bonds will be covered in much greater detail in a subsequent chapter, where we will look at a full range of issues from the perspective of the issuer (i.e., borrower). However, for now we are only going to consider bonds from the investor perspective. You need to understand just a few basics: (1) each bond will have an associated "face value" (e.g., $1,000) that corresponds to the amount of principal to be paid at maturity, (2) each bond will have a contract or stated interest rate (e.g., 5% -- meaning that the bond pays interest each year equal to 5% of the face amount), and (3) each bond will have a term (e.g., 10 years -- meaning the bonds mature 10 years from the designated issue date). In other words, a $1,000, 5%, 10-year bond would pay $50 per year for 10 years (as interest), and then pay $1,000 at the stated maturity date 10 years after the original date of the bond.

THE ISSUE PRICE: How much would you pay for the above 5%, 10-year bond: Exactly $1,000, more than $1,000, or less than $1,000? The answer to this question depends on many factors, including the credit-worthiness of the issuer, the remaining time to maturity, and the overall market conditions. If the "going rate" of interest for other bonds was 8%, you would likely avoid this 5% bond (or, only buy it if it were issued at a deep discount). On the other hand, the 5% rate might look pretty good if the "going rate" was 3% for other similar bonds (in which case you might actually pay a premium to get the bond). So, bonds might have an issue price that is at their face value (also known as "par"), or above (at a premium) or below (at a discount) face. The price of a bond is typically stated as percentage of face; for example 103 would mean 103% of face, or $1,030. The specific calculations that are used to determine the price one would pay for a particular bond are revealed in a subsequent chapter.

RECORDING THE INITIAL INVESTMENT: An Investment in Bonds account (at the purchase price plus brokerage fees and other incidental acquisition costs) is established at the time of purchase. Importantly, premiums and discounts are not recorded in separate accounts:

ILLUSTRATION OF BONDS PURCHASED AT PAR:

| 1-1-X3 |

Investment in Bonds |

5,000 |

||

|

Cash |

5,000 |

|||

| To record the purchase of five $1,000, 5%, 3-year bonds at par -- interest payable semiannually |

The above entry reflects a bond purchase as described, while the following entry reflects the correct accounting for the receipt of the first interest payment after 6 months.

| 6-30-X3 |

Cash |

125 |

||

|

Interest Income |

125 |

|||

| To record the receipt of an interest payment ($5,000 par X .05 interest X 6/12 months) |

Now, the entry that is recorded on June 30 would be repeated with each subsequent interest payment -- continuing through the final interest payment on December 31, 20X5. In addition, at maturity, when the bond principal is repaid, the investor would make this final accounting entry:

| 12-31-X5 |

Cash |

5,000 |

||

|

Investment in Bonds |

5,000 |

|||

| To record the redemption of bond investment at maturity |

ILLUSTRATION OF BONDS PURCHASED AT A PREMIUM: When bonds are purchased at a premium, the investor pays more than the face value up front. However, the bond's maturity value is unchanged; thus, the amount due at maturity is less than the initial issue price! This may seem unfair, but consider that the investor is likely generating higher annual interest receipts than on other available bonds -- that is why the premium was paid to begin with. So, it all sort of comes out even in the end. Assume the same facts as for the above bond illustration, but this time imagine that the market rate of interest was something less than 5%. Now, the 5% bonds would be very attractive, and entice investors to pay a premium:

| 1-1-X3 |

Investment in Bonds |

5,300 |

||

|

Cash |

5,300 |

|||

| To record the purchase of five $1,000, 5%, 3-year bonds at 106 -- interest payable semiannually |

The above entry assumes the investor paid 106% of par ($5,000 X 106% = $5,300). However, remember that only $5,000 will be repaid at maturity. Thus, the investor will be "out" $300 over the life of the bond. Thus, accrual accounting dictates that this $300 "cost" be amortized ("recognized over the life of the bond") as a reduction of the interest income:

| 6-30-X3 |

Cash |

125 |

||

|

Interest Income |

75 |

|||

|

Investment in Bonds |

50 |

|||

| To record the receipt of an interest payment ($5,000 par X .05 interest X 6/12 months = $125; $300 premium X 6 months/36 months = $50 amortization) |

The preceding entry is undoubtedly one of the more confusing entries in accounting, and bears additional explanation. Even though $125 was received, only $75 is being recorded as interest income. The other $50 is treated as a return of the initial investment; it corresponds to the premium amortization ($300 premium allocated evenly over the life of the bond -- $300 X (6 months/36 months)) and is credited against the Investment in Bonds account. This process of premium amortization (and the above entry) would be repeated with each interest payment date. Therefore, after three years, the Investment in Bonds account would be reduced to $5,000 ($5,300 - ($50 amortization X 6 semiannual interest recordings)). This method of tracking amortized cost is called the straight-line method. There is another conceptually superior approach to amortization, called the effective-interest method, that will be revealed in later chapters. However, it is a bit more complex and the straight-line method presented here is acceptable so long as its results are not materially different than would result under the effective-interest method.

In addition, at maturity, when the bond principal is repaid, the investor would make this final accounting entry:

| 12-31-X5 |

Cash |

5,000 |

||

|

Investment in Bonds |

5,000 |

|||

| To record the redemption of bond investment at maturity |

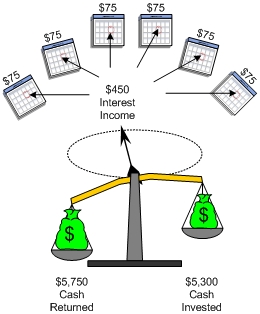

In an attempt to make sense of the above, perhaps it is helpful to reflect on just the "cash out" and the "cash in." How much cash did the investor pay out? It was $5,300; the amount of the initial investment. How much cash did the investor get back? It was $5,750; $125 every 6 months for 3 years and $5,000 at maturity. What is the difference? It is $450 ($5,750 - $5,300) -- which is equal to the income recognized above ($75 every 6 months, for 3 years). At its very essence, accounting measures the change in money as income.

Bond accounting is no exception, although it is sometimes illusive to see. The following "amortization" table reveals certain facts about the bond investment accounting, and is worth studying to be sure you understand each amount in the table. Be sure to "tie" the amounts in the table to the entries above:

Sometimes, complex topics like this are easier to understand when you think about the balance sheet impact of a transaction. For example, on 12-31-X4, Cash is increased $125, but the Investment in Bond account is decreased by $50 (dropping from $5,150 to $5,100). Thus, total assets increased by a net of $75. The balance sheet remains in balance because the corresponding $75 of interest income causes a corresponding increase in retained earnings.

ILLUSTRATION OF BONDS PURCHASED AT A DISCOUNT: The discount scenario is very similar to the premium scenario, but "in reverse." When bonds are purchased at a discount, the investor pays less than the face value up front. However, the bond's maturity value is unchanged; thus, the amount due at maturity is more than the initial issue price! This may seem like a bargain, but consider that the investor is likely getting lower annual interest receipts than is available on other bonds -- that is why the discount existed in the first place. Assume the same facts as for the previous bond illustration, except imagine that the market rate of interest was something more than 5%. Now, the 5% bonds would not be very attractive, and investors would only be willing to buy them at a discount:

| 1-1-X3 |

Investment in Bonds |

4,850 |

||

|

Cash |

4,850 |

|||

| To record the purchase of five $1,000, 5%, 3-year bonds at 97 -- interest payable semiannually |

The above entry assumes the investor paid 97% of par ($5,000 X 97% = $4,850). However, remember that a full $5,000 will be repaid at maturity. Thus, the investor will get an additional $150 over the life of the bond. Accrual accounting dictates that this $150 "benefit" be recognized over the life of the bond as an increase in interest income:

| 6-30-X3 |

Cash |

125 |

||

|

Investment in Bonds |

25 |

|

||

|

Interest Income |

150 |

|||

| To record the receipt of an interest payment ($5,000 par X .05 interest X 6/12 months = $125; $150 discount X 6 months/36 months = $25 amortization) |

The preceding entry would be repeated at each interest payment date. Again, further explanation may prove helpful. In addition to the $125 received, another $25 of interest income is recorded. The other $25 is added to the Investment in Bonds account; as it corresponds to the discount amortization ($150 discount allocated evenly over the life of the bond -- $150 X (6 months/36 months)). This process of discount amortization would be repeated with each interest payment. Therefore, after three years, the Investment in Bonds account would be increased to $5,000 ($4,850 + ($25 amortization X 6 semiannual interest recordings)). This is another example of the straight-line method of amortization since the amount of interest is the same each period.

When the bond principal is repaid at maturity, the investor would also make this final accounting entry:

| 12-31-X5 |

Cash |

5,000 |

||

|

Investment in Bonds |

5,000 |

|||

| To record the redemption of bond investment at maturity |

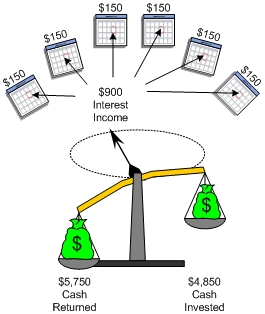

Let's consider the "cash out" and the "cash in." How much cash did the investor pay out? It was $4,850; the amount of the initial investment. How much cash did the investor get back? It is the same as it was in the preceding illustration -- $5,750; $125 every 6 months for 3 years and $5,000 at maturity. What is the difference? It is $900 ($5,750 - $4,850) -- which is equal to the income recognized above ($150 every 6 months, for 3 years).

Can you picture the balance sheet impact on 6-30-X5? Cash increased by $125, and the Investment in Bond account increased $25. Thus, total assets increased by $150. The balance sheet remains in balance because the corresponding $150 of interest income causes a corresponding increase in retained earnings.

THE EQUITY METHOD OF ACCOUNTING

THE EQUITY METHOD: On occasion, an investor may acquire enough ownership in the stock of another company to permit the exercise of "significant influence" over the investee company. For example, the investor has some direction over corporate policy, and can sway the election of the board of directors and other matters of corporate governance and decision making. Generally, this is deemed to occur when one company owns more than 20% of the stock of the other -- although the ultimate decision about the existence of "significant influence" remains a matter of judgment based on an assessment of all facts and circumstances. Once significant influence is present, generally accepted accounting principles require that the investment be accounted for under the "equity method" (rather than the methods previously discussed, such as those applicable to trading securities or available for sale securities).

With the equity method, the accounting for an investment is set to track the "equity" of the investee. That is, when the investee makes money (and experiences a corresponding increase in equity), the investor will similarly record its share of that profit (and vice-versa for a loss). The initial accounting commences by recording the investment at cost:

| 4-1-X3 |

Investment |

50,000 |

||

|

Cash |

50,000 |

|||

| To record the purchase of 5,000 shares of Legg stock at $10 per share. Legg has 20,000 shares outstanding, and the investment in 25% of Legg (5,000/20,000 = 25%) is sufficient to give the investor significant influence |

Next, assume that Legg reports income for the three-month period ending June 30, 20X3, in the amount of $10,000. The investor would simultaneously record its "share" of this reported income as follows:

| 6-30-X3 |

Investment |

2,500 |

||

|

Investment Income |

2,500 |

|||

| To record investor's share of Legg's reported income (25% X $10,000) |

Importantly, this entry causes the Investment account to increase by the investor's share of the investee's increase in its own equity (i.e., Legg's equity increased $10,000, and the entry causes the investor's Investment account to increase by $2,500), thus the name "equity method." Notice, too, that the credit causes the investor to recognize income of $2,500, again corresponding to its share of Legg's reported income for the period. Of course, a loss would be reported in just the opposite fashion.

When Legg pays out dividends (and decreases its equity), the investor will need to reduce its Investment account:

| 7-01-X3 |

Cash |

1,000 |

||

|

Investment |

1,000 |

|||

| To record the receipt of $1,000 in dividends from Legg -- Legg declared and paid a total of $4,000 ($4,000 X 25% = $1,000) |

The above entry is based on the assumption that Legg declared and paid a $4,000 dividend on July 1. This treats dividends as a return of the investment (not income, because the income is recorded as it is earned rather than when distributed). In the case of dividends, notice that the investee's equity reduction is met with a corresponding proportionate reduction of the Investment account on the books of the investor.

Note that market-value adjustments are usually not utilized when the equity method is employed. Essentially, the Investment account tracks the equity of the investee, increasing as the investee reports income and decreasing as the investee distributes dividends.