Home

Bibliography

Contact

Interesting Articles

Accounting is based upon accrual concepts that report revenues as earned and expenses as incurred, rather than when received and paid. Accrual information is perhaps the best indicator of business success or failure. However, one cannot ignore the importance of cash flows. For example, a rapidly growing successful business can be profitable and still experience cash flow difficulties in trying to keep up with the need for expanded facilities and inventory. On the other hand, a business may appear profitable on an accrual basis, but may be experiencing delays in collecting receivables, and this can impose severe liquidity constraints. Or, a business may be paying generous dividends, but only because cash is being produced from the disposal of core assets. Sophisticated analysis of the balance sheet and income statement will often reveal such issues.

THE STATEMENT OF CASH FLOWS: Rather than depending upon sophisticated financial statement users to do their own detailed cash flow analysis, the accounting profession has seen fit to require another financial statement that clearly highlights the cash flows of a business entity. This required financial statement is appropriately named the Statement of Cash Flows. The Statement of Cash Flows can be seen as an outgrowth of the FASB's conceptual framework. The FASB cites one objective of financial reporting as follows: Information should be helpful in assessing the amounts, timing, and uncertainty of an organization's cash inflows and outflows. The applicable rules require that the statement of cash flows provide three broad categories that reveal information about operating activities, investing activities, and financing activities. In addition, businesses are required to reveal significant noncash investing/financing transactions.

CASH AND CASH EQUIVALENTS: In preparing the statement of cash flows, companies broadly define "cash" to consist of cash and items that are equivalent to cash. As a general rule, cash equivalents are short-term, highly liquid investments that mature in 90 days or less.

OPERATIVG, INVESTING AND FINANCING CAPACITIES

OPERATING ACTIVITIES: Cash inflows from operating activities consist of receipts from customers for providing goods and services, and cash received from interest and dividend income (as well as the proceeds received upon the sale of "trading securities"). Cash outflows consist of payments for inventory, employee salaries and wages, taxes, interest, and other normal business expenses (and the cost of "trading securities" purchased). To generalize, cash from operating activities is generally linked to those transactions and events that enter into the determination of income. However, another way to view "operating" cash flows is to include anything that is not an "investing" or "financing" cash flow as described below.

INVESTING ACTIVITIES: Cash inflows from investing activities result from items such as the sale of stock and bond investments (other than "trading securities"), disposal of long-term productive assets, and receipt of principal repayments on loans made to others. Cash outflows from investing activities include payments made to acquire long-term assets or long-term investments (other than "trading securities") in other firms, loans made by the entity to others, and similar items.

FINANCING ACTIVITIES: Cash inflows from financing activities relate to the proceeds received when a company issues its own stock or bonds, borrowings under mortgage notes and loans, and so forth. Cash outflows for financing activities include repayments of amounts borrowed, acquisitions of treasury stock, and dividend distributions to shareholders.

NONCASH INVESTING AND FINANCING ACTIVITIES

NONCASH EVENTS: A select set of important investing and financing activities occur without generating or consuming any cash. For example, a company may exchange common stock for land, or acquire a building in exchange for a note payable. While these transactions do not entail a direct inflow or outflow of cash, they do pertain to significant investing and/or financing events. When the FASB designed the statement of cash flows, they decided to require a separate section reporting these noncash items. Thus, the statement of cash flows is actually enhanced beyond its "title;" revealing the totality of investing and financing activities, whether or not cash is actually involved.

DIRECT APPROACH TO THE STATEMENT OF CASH FLOWS

EXAMINING A STATEMENT OF CASH FLOWS: Earlier in this chapter, you studied the income statement, statement of retained earnings, and balance sheet for Emerson Corporation. Before proceeding, spend just a few moments reviewing those financial statements. Then, examine the following statement of cash flows for Emerson Corporation. Everything within this cash flow statement is derived from the data and additional comments presented earlier for Emerson. At first, some of the cash flow statement will seem a bit mysterious, but a "line by line" explanation will follow. The tan bar at the left is not part of the statement; it is to facilitate the "line by line" discussion" (e.g. line F4 will refer to the 4th line in the financing activities section).

METHODS TO PREPARE A STATEMENT OF CASH FLOWS: There are several ways to go about preparing a statement of cash flows. You may hear about a "T" account approach or a "worksheet" approach for organizing data to present the statement. But, trying to learn the statement of cash flows by focusing on the specific method for its preparation can actually obscure your understanding of the statement. Let's first focus on our "line by line" understanding of how the content for Emerson's statement is derived. As you proceed, try to focus on understanding not memorization. The statement of cash flows draws on your complete understanding of accounting, and it is quite common for students to initially struggle with the statement; do not despair and do not give up!

OPERATING ACTIVITIES

LINE O1 -- CASH FLOWS FROM OPERATING ACTIVITIES: This line merely identifies the section:

LINE O2 -- CASH RECEIVED FROM CUSTOMERS: Emerson's customers paid $3,000,000 in cash:

How do we know this? Emerson's information system could be sufficiently robust that a "data base query" could produce this number for us. On the other hand, we can also infer this by reference to sales and receivables data found within the income statement and balance sheet:

Cash Received From Customers = Total Sales Minus the Increase in Net Receivables (or, plus a decrease in net receivables)

Cash Received From Customers = $3,250,000 - ($850,000 - $600,000)

Cash Received From Customers = $3,000,000

LINE 03 -- CASH PAID FOR: The line identifies the items relating to operating cash outflows:

LINE 04 -- CASH PAID FOR INVENTORY: Emerson's paid $1,050,000 of cash for inventory:

Determining the cash paid for inventory is perhaps one of the trickier calculations. Bear in mind that cost of goods sold is the dollar amount of inventory sold during the year. But, the amount of inventory actually purchased will be less than this amount if inventory on the balance sheet decreased during the year. This would mean that some of the cost of goods sold came from existing stock on hand rather than having all been purchased during the year. Conversely, purchases would be greater than cost of goods sold if inventory increased:

Inventory Purchased = Cost of Goods Sold Minus the Decrease in Inventory (or, plus an increase in inventory)

Inventory Purchased = $1,160,000 - ($220,000 - $180,000)

Inventory Purchased = $1,120,000

Cash Paid for Inventory = Inventory Purchases Minus the Increase in Accounts Payable (or, plus a decrease in accounts payable)

Cash Paid for Inventory = $1,120,000 - ($270,000 - $200,000)

Cash Paid for Inventory = $1,050,000

Emerson's payroll records would indicate the amount of cash paid for wages, but this number can also be determined by reference to wages expense in the income statement and wages payable on the balance sheet:

Cash Paid for Wages = Wages Expense Plus the Decrease in Wages Payable (or, minus an increase in wages payable)

Cash Paid for Wages = $450,000 + ($50,000 - $20,000)

Cash Paid for Wages = $480,000

Emerson not only paid out enough cash to cover wages expense, but an additional $30,000 as reflected by the overall decrease in wages payable. If wages payable had increased, the cash paid would have been less than wages expense.LINE 06, O7, O8 -- CASH PAID FOR INTEREST, OTHER OPERATING EXPENSES AND INCOME TAXES:

Emerson's cash payments for these items equaled the amount of expense in the income statement. Had there been related balance sheet accounts (e.g., interest payable, taxes payable, etc.), then the expense amounts would need to be adjusted in a manner similar to that illustrated for wages.

LINE 09 -- NET CASH PROVIDED BY OPERATING ACTIVITIES: This line merely provides a recap of the net effect of all operating activities. Overall, operations generated net positive cash flows of $800,000:

You may have noticed that two items within the income statement were not listed in the operating activities section of the cash flow statement. Specifically:

- Depreciation expense is in the income statement, but it is not an operating cash flow item. The reason is very simple; it is a noncash expense. Remember that depreciation is recorded via a debit to Deprecation Expense and a credit to Accumulated Depreciation. No cash is impacted by this expense entry (the "investing" cash outflow occurred when the asset was purchased), and

- The gain on sale of land in the income statement does not appear in the operating cash flows section. While the land sale may have produced cash, the entire proceeds will be listed in the investing activities section; it is a "nonoperating" item, and its full cash effect is listed elsewhere.

INVESTING ACTIVITIES

LINE I1 -- CASH FLOWS FROM INVESTING ACTIVITIES: This line merely identifies the section:

LINE I2 -- CASH FLOWS FROM SALE OF LAND: Emerson sold land for $750,000 during the year:

In actuality, it would be pretty easy to look up this transaction in the journal. The entry would look like this:

| XX-XX-X5 | Cash |

750,000 |

||

| Gain |

150,000 |

|||

| Land |

600,000 |

|||

| Sold land costing $600,000 for $750,000 |

But, it is not necessary to refer to the journal. Notice that land on the balance sheet decreased by $600,000 ($1,400,000 - $800,000), and that the income statement included a $150,000 gain. Applying a little "forensic" accounting allows you to deduce that $600,000 in land was sold for $750,000, to produce the $150,000 gain.

LINE I3 -- CASH FLOWS FROM PURCHASE OF EQUIPMENT: Emerson purchased equipment for $150,000 during the year:

Notice that equipment on the balance sheet increased by $150,000 ($1,050,000 - $900,000). We could confirm that this was a cash purchase by reference to the journal; such is assumed in this case.

LINE I4 -- NET CASH PROVIDED BY INVESTING ACTIVITIES: Emerson's overall investing activities generated $600,000 in cash during the year. This resulted from the net effects of disposing of land and purchasing equipment.

FINANCING ACTIVITIES

LINE F1 -- CASH FLOWS FROM FINANCING ACTIVITIES: This line merely identifies the section:

LINE F2 -- CASH PROCEEDS FROM ISSUING COMMON STOCK: This line reveals that $80,000 was received from issuing common stock.

LINE F3 -- CASH OUTFLOW FOR DIVIDENDS: The statement of retained earnings reveals that Emerson declared $50,000 in dividends. Since there is no dividend payable on the balance sheet, one can assume that all of the dividends were paid during the year:

LINE F4 -- CASH OUTFLOW FOR REPAYMENT OF LONG-TERM LOAN: The balance sheet reveals a $900,000 decrease in long-term debt ($1,800,000 - $900,000). This represented a significant use of cash during the year:

This line item reveals that Emerson has used much of the cash flow generated from operations and asset disposals to reduce the outstanding debt of the company.

LINE F5 -- NET CASH USED IN FINANCING ACTIVITIES: Emerson's overall financing activities used $870,000 in cash during the year. The bulk of this outflow was attributable to debt repayment.

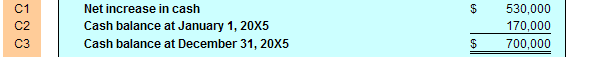

LINE C1, C2, C3 -- THE CHANGE IN CASH: Emerson's cash flow statement reveals a $530,000 increase in cash during the year ($800,000 from positive operating cash flow, $600,000 from positive investing cash flow, and $870,000 from negative financing cash flow). This change in cash is confirmed by reference to the beginning and ending cash balances on the balance sheet:

NONCASH INVESTING/FINANCING ACTIVITIES

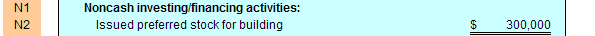

LINE N1, N2 -- NONCASH INVESTING AND FINANCING ACTIVITIES: Emerson issued $300,000 of preferred stock for a building. This falls into the special section for revealing the noncash investing and financing events:

RECONCILIATION OF INCOME TO OPERATING CASH FLOWS: The statement of cash flows just presented is specifically known as the "direct approach." The direct approach is the preferred approach. It is so named because the cash items entering into the determination of operating cash flow are specifically identified. In many respects, this presentation of operating cash flows resembles a cash basis income statement. An alternative "indirect" approach will be presented shortly.

But first, be aware that companies who choose to use the direct approach must supplement the cash flow statement with a reconciliation of income to cash from operations:

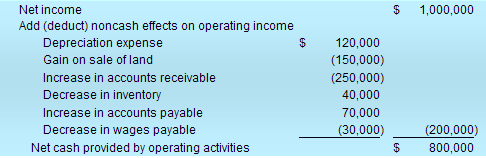

Notice that this reconciliation starts with the net income, and adjusts to the $800,000 net cash from operations. Some explanation may prove helpful:

- Depreciation is added back to net income, because it reduced income but did not consume any cash.

- Gain on sale of land is subtracted, because it increased income, but is not related to operations (remember, it is an investing item and the "gain" is not the sales price).

- Increase in accounts receivable is subtracted, because it represents uncollected sales included in income.

- Decrease in inventory is added, because it represents cost of sales from existing inventory (not a new cash purchase).

- Increase in accounts payable is added, because it represents expenses not paid.

- Decrease in wages payable is subtracted, because it represents a cash payment for something expensed in an earlier period.

Now, this can get rather confusing. Let's try to simplify it a bit. First, you can probably see why depreciation is added back.

But, the gain is likely fuzzy. It must be subtracted because you are trying to remove it from the operating number; it increased net income, but it is viewed as something other than operating, and that is why it is backed out. Conversely, a loss on such a transaction would be added.

The increase in accounts receivable represents sales that increased income but not cash. That is why it is subtracted. If you can relate to the receivables, a pattern will develop for the other items:

Increases in current assets related to operations will be subtracted, but decreases will be added

and, vice versa:

Increases in current liabilities related to operations will be added, but decreases will be subtracted

As a reminder, this reconciliation of income to operating cash is intended to supplement the direct approach to the statement of cash flows. You will likely find the reconciliation in notes to the financial statements.